Published on May 26, 2022

Mortgage Market Statistics - April and May 2022

Written by The Servion Group

Mortgage rates have been on a general upward trend for over a year and in the last few months, they’ve taken a big jump higher.

What's Driving the Rate Movement?

As always, there are multiple factors at work. For one, as the economy recovered from the COVID-19 pandemic, low interest rates fueled increased spending. At the same time, supply chain issues created shortages for items like microchips, building supplies and certain food items. These factors combined to drive inflation higher as supplies failed to meet demand. According to the latest Consumer Price Index (CPI), 12-month inflation hit 8.5% in March, the highest it’s been since 1981.

Adding to the inflationary pressures is Russia’s invasion of Ukraine, which has disrupted some financial markets. This war could also add to global food shortages as agriculture, fuel and fertilizer shipments from these countries are limited or disrupted.

Will Rates Reverse Course?

Very unlikely. As a mid-May Housing Wire article put it, "Rates will not come down this year. There is no spring buying season. The ARM and IO products are the same prices as the Conventional loans. FHA, VA and USDA aren’t accepted by sellers. Investors and trust funds keep buying the bottom of the market from under the first-time home buyer. Builders do not have inventory — or workers and supplies."

National Statistics

We’ve selected a few pieces of data on the national housing market to give you an idea of what’s happening around the country. These are not Servion-specific numbers but rather national housing market numbers.

- In late May, the average rate for a 30-year fixed mortgage was 5.46%, according to Fannie Mae. It was 2.96% a year earlier.

- The 30-year mortgage rate hasn't been this high since November/December 2008.

- For the week ending May 21, refinance application volume was 75% lower than a year ago.

- Purchasing is also down as people continue being priced out; purchase app volume for the week ending May 21 was down 16% from the same week last year.

- By the first week of May, homes were overvalued in 97% of U.S. cities, according to Moody's.

- Moody's says Dallas-Ft. Worth is the most overvalued area, with homes valued 60% above what the fundamentals would suggest.

Historical Perspective

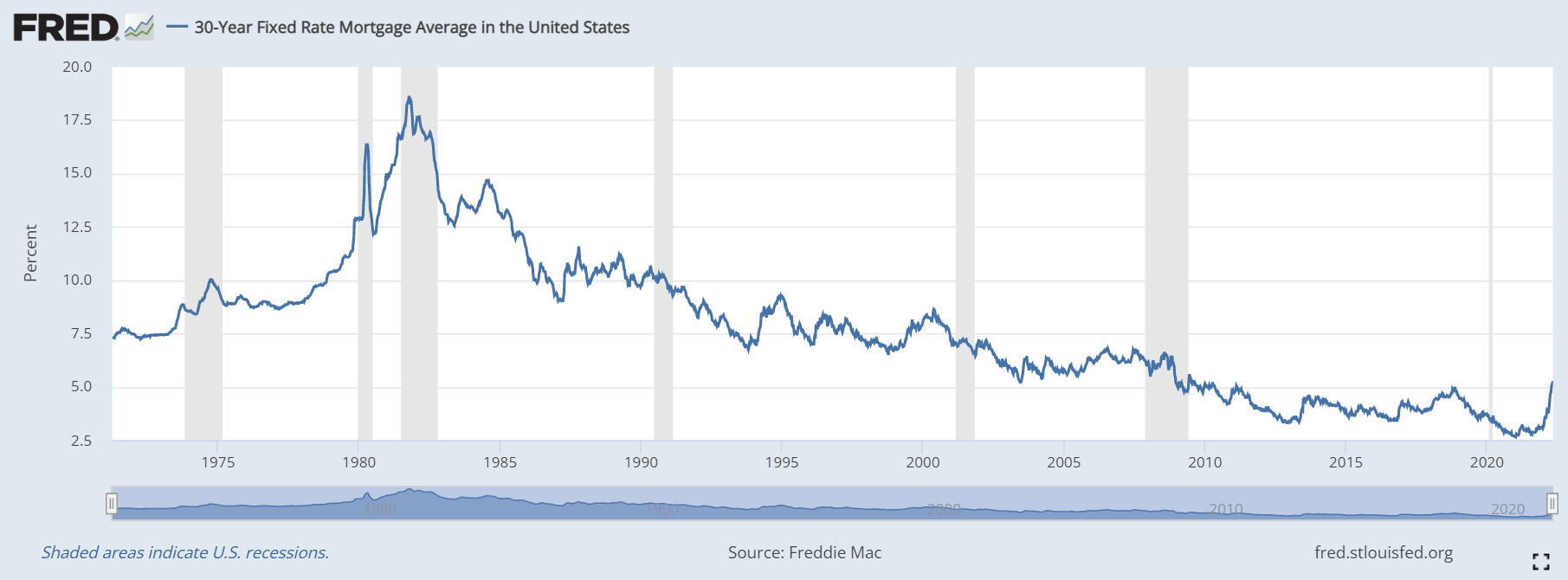

Rates are their highest since the Great Recession, but it's still worth remembering where rates have been throughout history. This graph from Freddie Mac and the St. Louis Federal Reserve shows the average 30-year mortgage rate since the early 1970s.

It may be a bit hard to read, but the highest point in the graph is October of 1981, when rates hit 18.39%.

Throughout the 1990s, rates ranged from 10.5% to a low of 6.81%. In the 2000s, 8.52% to 4.78%. In the 2010s, 5.5% to 3.1%.

When you step back and take the long view, today's rates are still not historically high. Of course, that doesn't change the fact that they are still higher than we've grown accustomed to over the past decade.

At this point, with a world full of uncertainty, no one can accurately predict what will happen in the mortgage market in the medium to long term. But you can rest assured that the Servion Mortgage team is here to support you no matter what.

-

Trending Categories