Published on February 11, 2021

Working Together for Faster Turnaround Times

Written by The Servion Group

Refining and Improving to Best Serve Our Mortgage Partners During an Extraordinary Time

Over the past 12 months, a persistent, record-low interest rate environment has led to record mortgage and refinance activity across most of the nation. This has resulted in record business volume for many mortgage companies, including Servion Mortgage. Though it's been a challenge at times, this unique period in history has taught us many valuable lessons, and we are applying those lessons to strengthen our company and our partner relationships.

Turnaround Times Were the Hot Topic When Our Survey Went Out. They Have Returned to Normal Since Then.

We conducted a survey of our mortgage partners in the fourth quarter of 2020, and for many survey respondents the thing they were most interested in was information regarding our turnaround times.

For perspective, our average monthly underwriting pipeline hovered around 300 files before the pandemic. By June of 2020, that had more than tripled, with more than 1,500 in the pipeline. This influx of files from the first two months of the pandemic is what caused underwriting turnaround times to slow down for a period of time.

It was during this time that we kicked our hiring efforts into overdrive. By October, we had added a significant number of employees and as a result we were able to work through the pipeline quicker. By January 2021, the pipeline was back down to approximately 400 files and our underwriting turn times were back to our normal 3-5 day target.

By January of 2021, turnaround times had returned to the normal range thanks to our staff size increases and operational efficiencies we worked hard to achieve.

Here's What We Did to Speed Things Up, and How You Can Help

Here are just some of the steps we've taken over the past year to strengthen our company and our ability to support partners.

- Hired approximately 80 new employees since March 2020.

- Added 2 experienced loan officers (retail).

- Plan to double the size of our underwriting, processing, closing and correspondent departments.

- Retained a talent recruiting company to support our unprecedented growth during this period.

- Cross-training personnel to be better able to handle absences, sick leave, etc. and to provide flexibility to move people to different areas as volume requires.

- New COO and mortgage management working closely to increase efficiencies.

- Creation of robust internal training program and clear career pathways for current employees to increase retention.

You can help improve turnaround times, too!

As a Servion Mortgage partner, you have the ability to help files move faster and more efficiently.

The best way to do that is by ensuring that you send us information that is as complete as possible. Remember, the file goes to underwriting, but you don’t go with it. As a result, the more information you can include up front, the better. The more complete the file is, the more efficient underwriting can be!

You can help the process go as quickly and smoothly as possible by:

- Planning ahead with your borrower - do they want to move in three months? One month?

- Get the borrower preapproved as soon as possible.

- Submitting applications that are as accurate and complete as possible.

- Gathering loan documentation up front (W2s, bank statements, etc.).

- Setting proper expectations with borrowers and Realtors.

In August we wrote an article with 3 tips on things you can do to make underwriting faster.

A Look Back: Perspective on Mortgage Volume

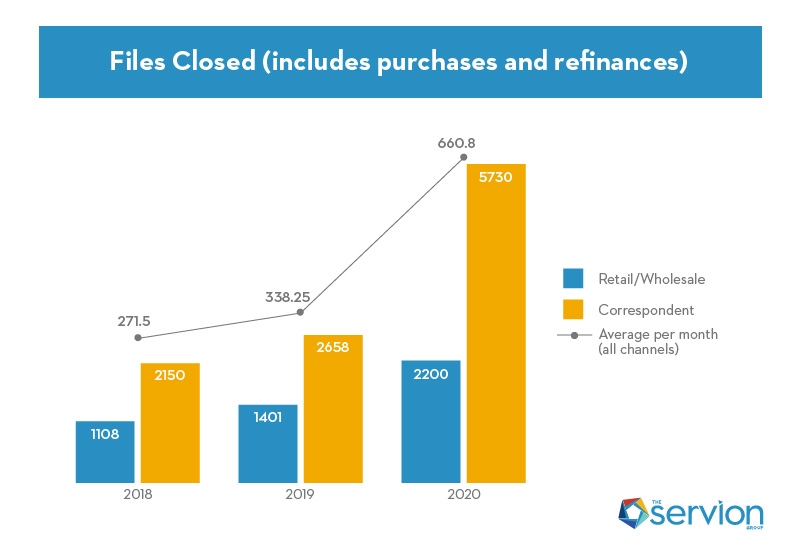

It has been decades since the mortgage industry was as busy as it was over the past year. It was easily the busiest year in the history of our company. To illustrate this, it may help to look at the following chart.

In other words, in 2020:

- Correspondent channel volume was 115.6% higher than 2019 and 166.5% higher than 2018.

- Retail/wholesale channel volume was 57% higher than 2019 and 98.6% higher than 2018.

- On average, we closed 95.4% more files per month than in 2019 and 143.4% more files per month than in 2018.

Additional Factors

In addition to historic volume, several other factors were at play:

- COVID-related shutdowns of title companies, recording offices and other government offices necessary to complete mortgage transactions.

- Changes to in-person appraisal rules and methods.

- Hiring challenges (most mortgage companies have been very busy, so there has been little incentive for employees to leave their employers).

As government offices reopened and everyone got used to doing business in the "new world," these factors began to fade and the pace of business was able to increase.

In Conclusion

Our partners relied on us more than ever in 2020. In 2021, with interest rates remaining at or near record lows, most experts are predicting another record year for home sales.

The Servion Group is well positioned to meet the needs of our partners in the coming year and many years to come. The pandemic's initial stages were challenging, but we emerged a bigger, stronger company with more capability than ever before.

We simply could not be more grateful to be in position to help. Your trust is everything and you drove our company to new heights. Thank you.

-

Trending Categories