Published on February 11, 2021

What Might the Financial Institution Workplace Look Like Post-COVID?

Written by The Servion Group

Could Pandemic-Era Changes Become Permanent Fixtures for Community Financial Institutions?

Credit unions and community banks faced unprecedented upheaval when the COVID-19 pandemic hit a year ago. Suddenly branches were closed, employees were sent home and the way financial institutions did business changed.

Now, with a vaccine being rolled out and people beginning to turn their thoughts to a post-COVID world, the question is whether any of the adaptations the pandemic forced upon us could have a more permanent role in the way FIs operate.

Nearly 75 Percent of Respondents Foresee Lasting Changes

Perhaps Unsurprisingly, Work From Home Ranks #1

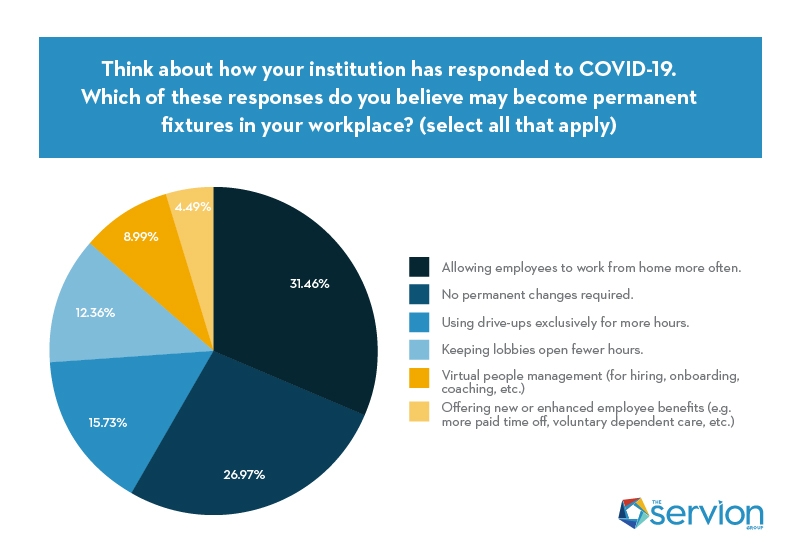

We surveyed our mortgage partners in Q4 and asked the question you see below. Nearly three out of every four respondents believe the workplace will undergo some type of permanent change after the pandemic.

Almost one third of respondents believe working from home more often will become the norm. This is probably not a huge surprise, as many FIs have performed well with large percentages of their employees at home. Moreover, recent data indicates FI employees have an overwhelming desire for flexible work arrangements going forward.

In-Branch vs. Drive-Up Hours

Our survey results also show that respondents believe pandemic-era closures of branches may have lasting effects. A combined 28 percent of respondents believe FIs may use drive-ups exclusively for more hours and keep lobbies open fewer hours.

We suspect (there's still too much uncertainty to be able to say "we know") that many institutions created appointment-driven processes for in-branch meetings with members/customers, and that as tough as the creation process may have been, they found that using appointments was beneficial in various ways, whether in terms of convenience, better preparation, or increased focus during the meeting due to lack of interruptions by other people coming into the lobby.

HR and Employee Benefits Changes

The pandemic put enormous stress on traditional methods of hiring, onboarding and coaching - what we'll call "people management." Many companies, including FIs, had to adjust by converting to a more virtual people management environment that relied on Zoom interviews, video onboarding and virtual tools for employee performance reviews.

Approximately 9 percent of our survey respondents believe such virtual people management practices will carry over and be used well after COVID has past.

Sick leave, paid time off and employee health benefits also took center stage during the crisis. The CARES Act and its relief measures provided additional sick leave and time off for employees who contracted COVID or needed to care for a loved one who was suffering from the virus.

Only about 1 in 20 respondents believed that their FI would offer any new or enhanced employee benefits in the wake of the crisis.

Nearly 27 Percent of Respondents Anticipate No Permanent Changes

Finally, as you can see in the pie chart above, more than one in four respondents believe their FI will not undergo any permanent change as a result of the pandemic. To be more precise, the respondents believed the permanent changes we offered as possible answers would not occur; perhaps there are other changes these respondents envision but we failed to include as possible answers.

In any event, this is a significant number of people, and it is a definite reminder that many FI leaders and employees believe that "getting back to normal" will indeed be possible.

Operational Priorities Post-COVID

Getting a Sense for How Community FIs May Address Certain Aspects of Their Business.

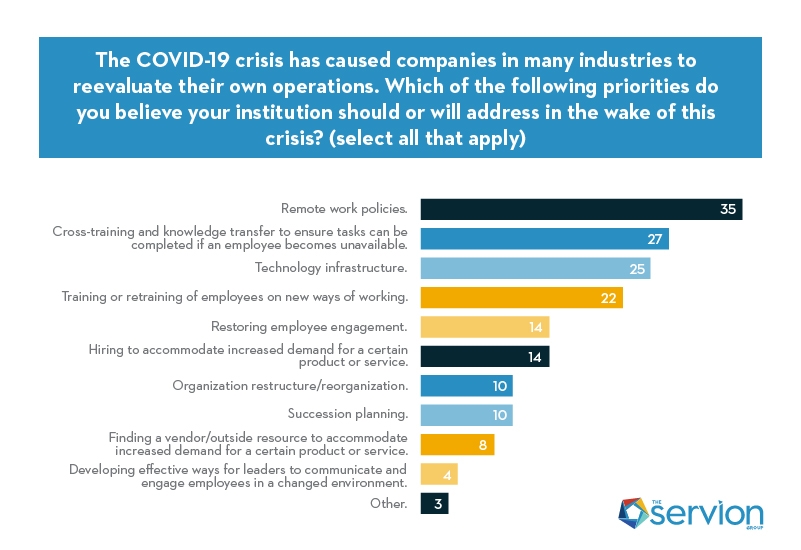

We asked our mortgage partners to tell us what priorities their FI should or would address in the wake of the crisis. The answers are below.

Please follow this link to read an in-depth analysis of this question.

In Conclusion

As optimism about vaccines has us thinking about finally putting this pandemic behind us, it is clear that some of the changes it forced upon community FIs may have a lasting impact. This in itself isn't surprising. The surprising part is that the changes, if any do stick, may be beneficial - for employees, members and customers and the institutions themselves.

After all the darkness of the last year, everyone deserves some positivity, however minor.

-

Trending Categories